NGO Registration

- NGO Registration

- Difference in Company, Society and Trust

- How to Start NGO – Form, Register and Run NGO

- Why to Register NGO

- How to run and manage NGO?

- Society Registration

- Society Registration Process and Procedure

- Name Change Process for Society

- How to Register NGO

- Societies Registration Act, 1860

- Public Charitable trust

- Registration Process of Public Charitable Trust

- After Registering the Public Charitable Trust

- Section 8 Non Profit Company Registration

NGO Resources

- NGO Resources

- NGO & Government of India

- NGO Partnership Registration

- Relations of NGOs with Business and Commerce

- Public Grievances Resolution related to Government

- Social Calendar

- NGO Management

- NGO Support

- What is NGO

- Voluntary Organisations and Volunteerism

- NGOs : Classification, Definitions, Typologies and Networks

- Understanding NGOs

- Can any Government Employee or Officer be the member of NGO?

- Income Exemption u/s 35AC Revoked

- Aims, Objectives & Programmes for NGO

NGO Funding & Grants

- NGO Funding

- Fundraising

- Funding and Grant Schemes

- Govt Schemes

- How to raise Funds for NGO

- Project Proposal Process

- Fundraising Ideas and Concepts

- Funding Agencies

- CSR Funding Empanelment by National CSR Hub

- CSR Funds through Corporate

- CSR Policy, Rules, Regulations and Guidelines of Government

- Government Funding Ministries

- International Funding Agencies

- Google for Nonprofits

- Fellowship

- CSR Funding

- Fund Raising

- Government Funding

- Grant Proposal for NGO Writing Preparation Process

- Project Proposals

Indian Non-Profits

- Andaman Nicobar

- Arunachal Pradesh

- Andhra Pradesh

- Assam

- Bihar

- Chandigarh

- Chhattisgarh

- Dadra Nagar Haveli

- Daman and Diu

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu Kashmir

- Jharkhand

- Ladakh

- Karnataka

- Kerala

- Lakshadweep

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Mumbai

- Nagaland

- Orissa

- Pondicherry

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- Uttar Pradesh

- Uttarakhand

- West Bengal

Now NGO Members’ record is mandatory to declare to get Government Funds

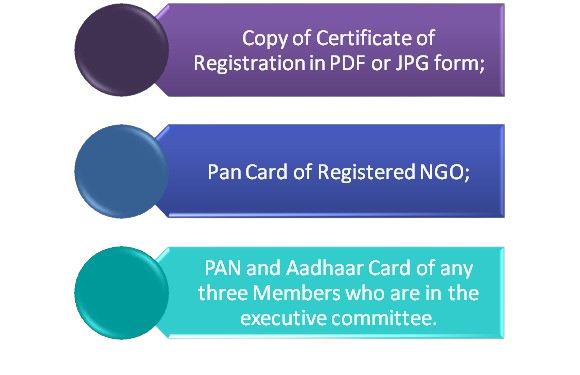

The Central Government has made a number of things mandatory in order to regulate corruption and misuse of NGOs, particularly in their financial matters. It was already mandatory to obtain Unique Identification numbers and have them registered on the portal of NITI Aayog. Now, in an effort to improve transparency and to keep a check on transactions involving misuse and corruption, the details of PAN and Aadhaar numbers of all the position holders and trustees of the organisation must be registered as well. Failing to do so would render them unable to apply for funding from any ministry of the government.

The NITI Aayog came upon this decision on 9 May 2016. All ministries have been instructed to process applications for grants and assistance from NGOs solely through the NITI Aayog’s portal.

Furthermore, development of a system to assign unique identification numbers to all charitable trusts and societies was also decided in another meeting regarding this matter, along with the provisions of direct benefit transfers and enrollment of Aadhaar.

In accordance with the provisions of the Aadhaar Act, this is one of the steps to involve the use of Aadhaar in various schemes of the government. Inclusion of the Aadhaar provides the factor of an additional security as there is biometric data of the participants involved which can be used to identify the individuals.

Another notification to heed to in particular is a June 26 notification of the Centre. It states that, in accordance with the Lokpal and Lok Ayukta Act (2013), the members handling an NGO’s everyday operations will be treated as public servants if an NGO acquires government funding exceeding Rs. 1 carore. This limit is marked at Rs. 10 lakh per year in case of foreign funding.

The notification also says that trustees and office holders of the NGOs must declare their moveable and immovable properties, cash, personal assets and jewellery by July 31.

They are subject to rules and regulations for government officials under the Prevention of Corruption Act too.

While the notification and regulations are an effort to increase the accountability of the NGOs, the notification has also caused a little chaos and raised some fears as it is being interpreted as an attempt to increase the Centre’s control in these regards.

The motive behind these reforms is to ease the process of identifying, verifying and maintanance for the receivers as well as the donors.