NGO Registration

- NGO Registration

- Difference in Company, Society and Trust

- How to Start NGO – Form, Register and Run NGO

- Why to Register NGO

- How to run and manage NGO?

- Society Registration

- Society Registration Process and Procedure

- Name Change Process for Society

- How to Register NGO

- Societies Registration Act, 1860

- Public Charitable trust

- Registration Process of Public Charitable Trust

- After Registering the Public Charitable Trust

- Section 8 Non Profit Company Registration

NGO Resources

- NGO Resources

- NGO & Government of India

- NGO Partnership Registration

- Relations of NGOs with Business and Commerce

- Public Grievances Resolution related to Government

- Social Calendar

- NGO Management

- NGO Support

- What is NGO

- Voluntary Organisations and Volunteerism

- NGOs : Classification, Definitions, Typologies and Networks

- Understanding NGOs

- Can any Government Employee or Officer be the member of NGO?

- Income Exemption u/s 35AC Revoked

- Aims, Objectives & Programmes for NGO

NGO Funding & Grants

- NGO Funding

- Fundraising

- Funding and Grant Schemes

- Govt Schemes

- How to raise Funds for NGO

- Project Proposal Process

- Fundraising Ideas and Concepts

- Funding Agencies

- CSR Funding Empanelment by National CSR Hub

- CSR Funds through Corporate

- CSR Policy, Rules, Regulations and Guidelines of Government

- Government Funding Ministries

- International Funding Agencies

- Google for Nonprofits

- Fellowship

- CSR Funding

- Fund Raising

- Government Funding

- Grant Proposal for NGO Writing Preparation Process

- Project Proposals

Indian Non-Profits

- Andaman Nicobar

- Arunachal Pradesh

- Andhra Pradesh

- Assam

- Bihar

- Chandigarh

- Chhattisgarh

- Dadra Nagar Haveli

- Daman and Diu

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu Kashmir

- Jharkhand

- Ladakh

- Karnataka

- Kerala

- Lakshadweep

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Mumbai

- Nagaland

- Orissa

- Pondicherry

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- Uttar Pradesh

- Uttarakhand

- West Bengal

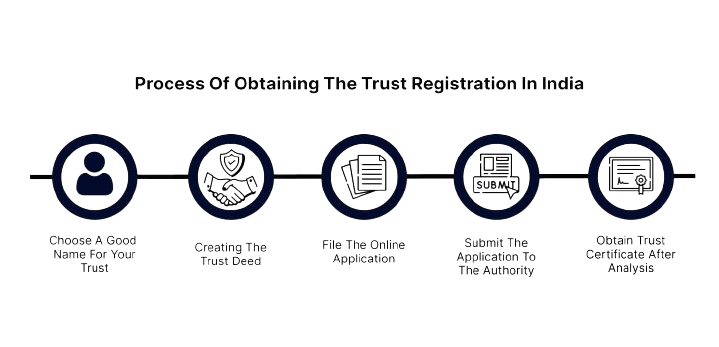

Registration Process of Public Charitable Trust

Trust Registration is processed under Indian Trust act 1882.

It is easy to register and manage Trust. Trust is a kind of recommended registration process to register Non Governmental Organisation (NGO). A Public Charitable is known as Non Profit Non Government Organisation. India Trust Act defines creating a Trust as “A trust is created when the author of the trust indicates with reasonable certainty by any words or acts:

(a) an intention on his part to create thereby a trust,

(b) the purpose of the trust,

(c) the beneficiary, and

(d) the trust-property, and (unless the trust is declared by will or the author of the trust is himself to be the trustee) transferred the trust-property to the trustee”. A Public Charitable Trust has to be registered with the office of the Sub Registrar of Revenue Department. The jurisdiction of the Sub Registrar is the locality of the office address of the Trust. In Maharashtra and Gujarat TRust is registered in Charity Commissioner office who has jurisdiction over the trust office. To register your trust you need to follow the steps described below:

Step 1 : Choose an appropriate name for your Trust. This is the basic step in registering your Trust. While choosing name take care that the proposed name should not suggest any kind of patronage by the government of India or any State government. It should not be under the restricted list of names as per the provisions of Emblems and Names Act, 1950. However, there is no restriction in using names that are already registered as a Trust in the Registrar office. In case the registrar at the Registrar office refuses to register your Trust under a given name in spite of it not violating any of the above mentioned rules, you can always file a complaint with the higher authorities and appropriate action would be taken.

Step 2 : Determine the Settler/ Author and Trustees of the intended Trust. In case of the number of Settlers/ Authors there is no clearly defined rule. It is subject to the decision of the Sub-Registrar at the Registrar Office. However, in most cases traditionally there is one Settler or Author. Minimum two Trustees are necessary and there is no limit on the Maximum number. Settler/ Author generally are not Trustees. It depends upon the choice, will and understanding of other Trustees. There is no Educational qualification needed to become a Trustee. Even an illiterate person can become a Trustee. Minimum age to become a Trustee is 18 years in case of female and 19 years in case of male. However, sometimes average of both the minimum ages, that is, 19.5 years is considered in general. A Trustee must be a resident of Republic of India. Foreigners, OCI card holders and NRIs residing abroad cannot become member of a Trust.

Step 3 : Prepare a Trust Deed as Memorandum of your Trust. This memorandum of Trust is is known as Trust deed and is extremely essential as the legal evidence of your Trust’s existence. The Trust Deed contains various Clauses. These are:

- Name Clause

- Settler and Trustee Clause

- Registered Office Clause

- Object Clause and Beneficiaries

- General Body Member Clause

A table containing names, address and occupation of all the Members along with their signatures should be formulated under the memorandum of association.

Rules and Regulations section includes the following Clauses:

- Membership Clause

- Subscription Clause

- Meeting Clause

- Committee/ Governing Body Clause

- Auditor

- Legal Procedures like appointment, removal or replacement of a trustee, their rights, duties and powers, etc.

- Property that shall devolve upon the trustee(s) under the trust for the benefit of the beneficiaries

Note: According to section 21 of the Indian Registration Act, 1908 a deed of trust relating to immovable property must, for the purposes of registration, contain a description of the property sufficient to identify it. - An intention to divest the trust property upon the trustee(s)

Note: The intention must be expressed in clear, simple language and with certainty.

Bylaws of the Trust

Mention each and every rule applicable to the Trust point wise. This includes sections of Income Tax act applicable, Indian Trust act and other laws applicable to run manage and implement the working of the Trust. Clearly mention all the procedures and conditions that should be followed to open and operate a bank account. These bylaws are included in the Trust deed. Proper procedures regarding changes, removal or addition of trustees must be established. Without inclusion of bylaws, the trust deed is incomplete and useless. This is why it is recommended to hire professionals who are experienced in preparing Trust deeds. Without a proper trust deed you might face issues in future like proving your trust’s legibility.

Step 4: Prepare all the documents that will be required at the time of submission. There is a Trust deed that is required. Trusts are irrevocable unless it is mentioned in the trust deed. This means that the trust cannot be wound up.

- The elements of that Trust deed which should be present in it are:

- Name and address of the Settler/ Author of the Trust.

- Names and addresses of the other trustees.

- Name of the trust.

- Minimum and maximum number of trustees. Minimum number is two while there is no limit for Maximum. But you must determine the maximum number your Trust can have. All the trustees together collectively govern the trust and are called Board of Trustees.

- Address of the registered office of the trust.

- Purpose behind formation of the Trust.

- Objectives of the trust.

- Rules and Regulations of the trust.

- Information about the intended Bank account: which bank and branch you shall open a bank account with.

- Tenure of the Trustees must be specified in the deed. It is not necessary to involve Electoral process in the appointment of trustees.

- Board of Trustees can also have various designations for trustees like Chairperson and Managing Trustee.

- Determine these posts and the responsibilities of each of these in the Trust deed.

- Though Trustees cannot draw any remuneration from the trust fund but they are eligible to receive compensation for the professional services they provide to the Trust. Determine this in the Trust deed.

- Date of execution of the Trust Deed.

- Details of the Trust Fund thus set up by the Settler and the movable immovable property included in the Trust Fund. Also contains information about the sources and activities through which income shall be earned and deposited in the Trust fund.

- Ways and plan in which the income shall be dispersed among beneficiaries or used in executing programs/ projects for their welfare.

- Rights, duties and limitations of the Trustees.

- Number of meetings to be organized each year and conditions regarding number of meetings mandatory for the Trustees to attend.

- Procedures to vary, alter or modify any clause in the Trust Deed.

- Conditions under which a Trustee shall cease to exist.

- B. The Trust Deed shall be prepared on a stamp paper whose value should be of certain percentage of the total value of Trust’s property. This percentage varies from state to state, for example, in Delhi this value is 8%.

Remember:Consent of all members is necessary whether verbal or written. Laws regarding the physical presence of trustees are different for different states. However, physical presence of settler is compulsory everywhere in India. In some states instead of physical presence of the Trustees, their original photo Ids and self attested photocopy is sufficient. At the time of registration, only the Settler and two witnesses are required to be present in front of the Sub-registrar under whose jurisdiction the registered office address comes. Sub-registrar will check IDs of these people. After that the Trust Deed will go to the counter where data entry takes place. In the end, Settler and two witnesses will be photographed. You will need to pay a fee of Rs. 1100 for this process. Of this amount, Rs. 100 will be the registration fee and Rs. 1000 will be the charges of keeping a copy of the Trust Deed with the sub-registrar.

After about one week of submitting the papers, you can go back to the registrar’s office to receive a certified copy of the Trust Deed. - C. To register the Trust Deed with the Local Registrar under the Indian Trusts Act there are certain requirements. These are:

- Trust Deed on stamp paper of requisite value (as stated above)

- Two passport size photograph & self attested copy of the proof of identity of the settler

- Two passport size photograph & self attested copy of the proof of identity of each trustee

Note:two photos are necessary as one will be pasted on the Trust deed while the other is pasted on the registry detail that is stored in the records. Aadhar card as identity proof is preferred however, it is not mandatory. Though the Supreme Court ruling has stated clearly that Aadhar card must not be made compulsory but some Registrars do not comply. They might pose obstacle if Aadhar card is not provided with the documents. Voter ID, Passport, any other such photo ID card with address mentioned on it is applicable till further notification. Driving License as identity proof is acceptable at some places while some do not consider it. All these conditions differ from state to state, for example, in Haryana Aadhar card is necessary and out of the two witness one must be a registered lawyer. Two witnesses are necessary throughout India. These witnesses identify the trustees and the settler. One passport size photograph (varies from state to state. Some require photo some don’t) & copy of the proof of identity of each of the two witnesses is needed. - Signature of settler on all the pages of the Trust Deed.

- Some states like Rajasthan, Madhya Pradesh have made Pan Card mandatory. While in others if the amount of Trust property/ a part of it is more than Rs 20,000 then Pan Card is compulsory.

- Proof of the registered office address of the Trust must be attached with the Trust deed. This can be electricity bill, water bill, registration certificate. You might have to submit a non objection letter signed by the land owner with his identity proof. Generally, the Trust is registered at the Registrar office of the state/ area under whose jurisdiction the official address of the Trust comes. However, please note that the office address of the Trust is not counted among the Trust’s property. Office address can be of any place in India, though there are few restrictions at some places. For example, in case of Delhi the registered office premises must be in legally authorized / registered residential or commercial places. Industrial buildings, farm houses and agricultural land cannot be used as office address. The office address must be registered with the local sub-registrar. Unauthorized addresses cannot be used. There are no clear rules about the office address in the Indian Trust Act or the Registration Act. The parameters regarding this are left to the judgment of the sub- registrar and the prevalent norms in the particular state. If you being given an extremely difficult time by the sub-registrar you can definitely challenge this legally in court. Settler or Trustees can add more than one address as the Trust’s office address. This address shall be added as additional administrative office in case they wish to open another branch of their Trust. This can be used while opening a bank account or opening more branches in future.

- You must mention the property registered in your Trust’s name and attach its proof with the documents you shall submit at the time of registration. Value of the Trust’s property must be mentioned in the Trust Deed. This property can be any movable or immovable asset. Under immovable asset comes the land, building or plot while movables ones consist of cash amount. Movable property has no maximum or minimum ceiling. It is not compulsory that you have to include immovable property in the Trust deed. If your Trust has some property mention it with its value and if not do not fret. It is okay to register a Trust that doesn’t have its own property.

Note:two photos are necessary as one will be pasted on the Trust deed while the other is pasted on the registry detail that is stored in the records. Aadhar card as identity proof is preferred however, it is not mandatory. Though the Supreme Court ruling has stated clearly that Aadhar card must not be made compulsory but some Registrars do not comply. They might pose obstacle if Aadhar card is not provided with the documents. Voter ID, Passport, any other such photo ID card with address mentioned on it is applicable till further notification. Driving License as identity proof is acceptable at some places while some do not consider it. All these conditions differ from state to state, for example, in Haryana Aadhar card is necessary and out of the two witness one must be a registered lawyer. Two witnesses are necessary throughout India. These witnesses identify the trustees and the settler. One passport size photograph (varies from state to state. Some require photo some don’t) & copy of the proof of identity of each of the two witnesses is needed. - Trust Deed on stamp paper of requisite value (as stated above)

- Two passport size photograph & self attested copy of the proof of identity of the settler

- Two passport size photograph & self attested copy of the proof of identity of each trustee

- Signature of settler on all the pages of the Trust Deed

-

- Some states like Rajasthan, Madhya Pradesh have made Pan Card mandatory. While in others if the amount of

- Trust property/ a part of it is more than Rs 20,000 then Pan Card is compulsory.

- Proof of the registered office address of the Trust must be attached with the Trust deed. This can be electricity bill, water bill, registration certificate. You might have to submit a non objection letter signed by the land owner with his identity proof. Generally, the Trust is registered at the Registrar office of the state/ area under whose jurisdiction the official address of the Trust comes. However, please note that the office address of the Trust is not counted among the Trust’s property. Office address can be of any place in India, though there are few restrictions at some places. For example, in case of Delhi the registered office premises must be in legally authorized / registered residential or commercial places. Industrial buildings, farm houses and agricultural land cannot be used as office address. The office address must be registered with the local sub-registrar. Unauthorized addresses cannot be used. There are no clear rules about the office address in the Indian Trust Act or the Registration Act. The parameters regarding this are left to the judgment of the sub- registrar and the prevalent norms in the particular state. If you being given an extremely difficult time by the sub-registrar you can definitely challenge this legally in court. Settler or Trustees can add more than one address as the Trust’s office address. This address shall be added as additional administrative office in case they wish to open another branch of their Trust. This can be used while opening a bank account or opening more branches in future.

- You must mention the property registered in your Trust’s name and attach its proof with the documents you shall submit at the time of registration. Value of the Trust’s property must be mentioned in the Trust Deed. This property can be any movable or immovable asset. Under immovable asset comes the land, building or plot while movables ones consist of cash amount. Movable property has no maximum or minimum ceiling. It is not compulsory that you have to include immovable property in the Trust deed. If your Trust has some property mention it with its value and if not do not fret. It is okay to register a Trust that doesn’t have its own property.To register the Trust Deed with the Local Registrar under the Indian Trusts Act there are certain requirements. These are:

- Trust Deed on stamp paper of requisite value (as stated above)

- Two passport size photograph & self attested copy of the proof of identity of the settler

- Two passport size photograph & self attested copy of the proof of identity of each trustee

Note:two photos are necessary as one will be pasted on the Trust deed while the other is pasted on the registry detail that is stored in the records. Aadhar card as identity proof is preferred however, it is not mandatory. Though the Supreme Court ruling has stated clearly that Aadhar card must not be made compulsory but some Registrars do not comply. They might pose obstacle if Aadhar card is not provided with the documents. Voter ID, Passport, any other such photo ID card with address mentioned on it is applicable till further notification. Driving License as identity proof is acceptable at some places while some do not consider it. All these conditions differ from state to state, for example, in Haryana Aadhar card is necessary and out of the two witness one must be a registered lawyer. Two witnesses are necessary throughout India. These witnesses identify the trustees and the settler. One passport size photograph (varies from state to state. Some require photo some don’t) & copy of the proof of identity of each of the two witnesses is needed.

- D. The government registration fee applicable to register the Trust is valued according to Revenue Tax rules in certain states. It is calculated at the time of the registration only; hence it cannot be determined beforehand. There is a minimum amount of the applicable fee that has to be paid, via a demand draft, online demand draft or stamp paper of that particular value, at the time of submission of documents. Rest of the applicable fee can be paid later at the registrar office or to authorized associate revenue agency after the full value has been calculated. Remember, the fee varies from state to state.

- E. The Trust deed should contain aims and objectives of the Trust pertaining to social welfare, child welfare, human development, environmental protection and old age homes etc. If you have a specific objective behind formation of your Trust you can include that specific objective as primary objective of the Trust along with other general social welfare objectives. Most objectives are co-related to each other. Consultants usually include specific objectives with the objectives required by the government bodies/ ministries. You can even work on one objective out of the ones you have mentioned in the Trust deed.

F. Working area or area of operation is mentioned in the Trust Deed. Usually a Trust registered anywhere in India has a national status. However, due to the absence of clearly defined laws in this case has led to bureaucratic confusions and different registrars have their own parameters regarding this. An organization registered as Delhi is always considered as a National organization. It is left up to the founder’s will regarding where they want to register their Trust. There isn’t any issue in receiving funding or projects from the government department of any state or central Ministry regarding this.

Step 5: Submit the Trust Deed, along with properly attested photocopies with the local registrar. Photocopy of the Trust Deed must be signed by the settler on every page. At the time of registration, the settler & two witnesses must be physically present along with their identity proofs (original as well as self attested photo copy). However there is a dispute regarding the presence of Trustees. Some states make it necessary for the Trustees to be physically present while with some states their written consent along with their identity proofs (original as well as self attested photo copy) is sufficient.

Step 6: The Registrar will retain the photocopy & return the original registered copy of the Trust Deed.

Step 7: After submitting all the required documents and completing all formalities it takes a minimum of 7 working days to obtain registration certificate. Though it isn’t mentioned in any of the rules but certain registrars might want to verify the registered office address by sending an official letter at that place for verification.

After Registering the Public Charitable Trust

Public Charitable Trust– Introduction

Charitable Trust Registration