NGO Registration

- NGO Registration

- Difference in Company, Society and Trust

- How to Start NGO – Form, Register and Run NGO

- Why to Register NGO

- How to run and manage NGO?

- Society Registration

- Society Registration Process and Procedure

- Name Change Process for Society

- How to Register NGO

- Societies Registration Act, 1860

- Public Charitable trust

- Registration Process of Public Charitable Trust

- After Registering the Public Charitable Trust

- Section 8 Non Profit Company Registration

NGO Resources

- NGO Resources

- NGO & Government of India

- NGO Partnership Registration

- Relations of NGOs with Business and Commerce

- Public Grievances Resolution related to Government

- Social Calendar

- NGO Management

- NGO Support

- What is NGO

- Voluntary Organisations and Volunteerism

- NGOs : Classification, Definitions, Typologies and Networks

- Understanding NGOs

- Can any Government Employee or Officer be the member of NGO?

- Income Exemption u/s 35AC Revoked

- Aims, Objectives & Programmes for NGO

NGO Funding & Grants

- NGO Funding

- Fundraising

- Funding and Grant Schemes

- Govt Schemes

- How to raise Funds for NGO

- Project Proposal Process

- Fundraising Ideas and Concepts

- Funding Agencies

- CSR Funding Empanelment by National CSR Hub

- CSR Funds through Corporate

- CSR Policy, Rules, Regulations and Guidelines of Government

- Government Funding Ministries

- International Funding Agencies

- Google for Nonprofits

- Fellowship

- CSR Funding

- Fund Raising

- Government Funding

- Grant Proposal for NGO Writing Preparation Process

- Project Proposals

Indian Non-Profits

- Andaman Nicobar

- Arunachal Pradesh

- Andhra Pradesh

- Assam

- Bihar

- Chandigarh

- Chhattisgarh

- Dadra Nagar Haveli

- Daman and Diu

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu Kashmir

- Jharkhand

- Ladakh

- Karnataka

- Kerala

- Lakshadweep

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Mumbai

- Nagaland

- Orissa

- Pondicherry

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- Uttar Pradesh

- Uttarakhand

- West Bengal

Non Profit Company Registration

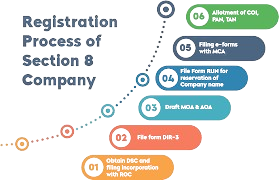

Registration Process of Not Profit Company under Section 8 as NGO

To know how to register Non Profit Company as a NGO you can check the required process and information given here. A Non Profit Company to promote art, science, charity, religion or commerce for social development, social welfare and for charity can be registered under section 8 of the Indian Companies Act, 1956. But remember the profits, if any, cannot be divided among its members/directors. Instead it can only be used to promote the objectives of the company that are social welfare, charity and not for profit. For this a Memorandum and Article of Association is required. No stamp paper is needed. At least 3 members are needed to formulate a Section 8 company while there is no upper limit on it. Section 8 is the same Section 25 (old Companies Act, 1956) with new updates and additions under the new Companies Act 2013. Non Profit Company under section 8 is one of the very popular registration form for Non- Profit Organisations in India.

To register a Non-Profit Company under section 8, the process is similar to that of other companies. You will just need an additional license. The Non Profit Company Registration process and procedure to get registered in a nutshell is:

- You will need to check the availability of desired name first. For this file Form INC-1 (without adding “Limited” or “Private Limited” to the name) with the Registrar of Companies (ROC) along with a fee of Rs 500/-. Provide at least three other names (with priority order) in case the name you desire is not available or acceptable.

- After the availability of name is confirmed, write an application in E form 24A online to the regional director of the company law board along with three copies of memorandum and articles of association. It must be signed by all the promoters with their details like names, address and occupation. There must be a declaration (on prescribed Stamp Paper) with it by an advocated or registered Chartered Accountant stating that all the provisions of the Act have been complied with. Three copies of the list containing names, occupation and addresses of all the board members and partners should also be attached with this.

- At the time of submitting application or within 7 days, a statement depicting all the assets and liabilities of the company with its estimated value has to be submitted. Sources of income, an estimate of future annual income and expenditures should also be included with this.

- Submit a brief description of the proposed work to be done after registration. It should specify the grounds on which application has been made.

- Every person signing the application must make a declaration that they are doing this with their own will and not under any kind of influence or pressure. They must declare that they have a sound mind and aren’t convicted by court for any offence. Their stand shouldn’t stand disqualified under section 203 of the Companies Act, if in case, appointed as a director.

- Furnish a copy of the application as well as each and every document (that was filed previously to the regional director of the company law board) to the Registrar of Companies of the state where the registered office is/ supposed to be located.

- Within 7 days of submitting the application to the regional director of the company law board, you will have to publish a notice (in the prescribed format) in the vernacular regional language newspaper as well as English newspaper of the state where your registered office will be/ is located.

- The regional director will look into the application and in case there is no objection he shall consult with the concerned authorities/ departments or ministry within 30 days to determine whether you will receive registration or not. The concerned ROC may consult District Magistrate under whose jurisdiction the registered office is/ to be located. Copy sent to Regional Director is generally received directly by ROC from DM.

- If required, the regional director may consult the State Government too. He may also consult concerned ministry.

- After taking in account the views of District Magistrate and the concerned ministries, regional director shall take the decision of granting license or not. Generally the entire process is completed within 30 days of filing application with the regional director.

- The regional director may suggest any modification, alteration or addition/ removal in the memorandum and articles of association.

- There is an additional requirement to obtain the license: Form RD-1 must be filed. After you have obtained the license number, you can incorporate the company by filing e forms INC-7, INC-22 and DIR-12 or e-forms INC-7 and DIR-12 as applicable.

You can take consultation to form the Non Profit Company through a Chartered Accountant, Law Firm or NGO Consultancy for Company Registration.