NGO Registration

- NGO Registration

- Difference in Company, Society and Trust

- How to Start NGO – Form, Register and Run NGO

- Why to Register NGO

- How to run and manage NGO?

- Society Registration

- Society Registration Process and Procedure

- Name Change Process for Society

- How to Register NGO

- Societies Registration Act, 1860

- Public Charitable trust

- Registration Process of Public Charitable Trust

- After Registering the Public Charitable Trust

- Section 8 Non Profit Company Registration

NGO Resources

- NGO Resources

- NGO & Government of India

- NGO Partnership Registration

- Relations of NGOs with Business and Commerce

- Public Grievances Resolution related to Government

- Social Calendar

- NGO Management

- NGO Support

- What is NGO

- Voluntary Organisations and Volunteerism

- NGOs : Classification, Definitions, Typologies and Networks

- Understanding NGOs

- Can any Government Employee or Officer be the member of NGO?

- Income Exemption u/s 35AC Revoked

- Aims, Objectives & Programmes for NGO

NGO Funding & Grants

- NGO Funding

- Fundraising

- Funding and Grant Schemes

- Govt Schemes

- How to raise Funds for NGO

- Project Proposal Process

- Fundraising Ideas and Concepts

- Funding Agencies

- CSR Funding Empanelment by National CSR Hub

- CSR Funds through Corporate

- CSR Policy, Rules, Regulations and Guidelines of Government

- Government Funding Ministries

- International Funding Agencies

- Google for Nonprofits

- Fellowship

- CSR Funding

- Fund Raising

- Government Funding

- Grant Proposal for NGO Writing Preparation Process

- Project Proposals

Indian Non-Profits

- Andaman Nicobar

- Arunachal Pradesh

- Andhra Pradesh

- Assam

- Bihar

- Chandigarh

- Chhattisgarh

- Dadra Nagar Haveli

- Daman and Diu

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu Kashmir

- Jharkhand

- Ladakh

- Karnataka

- Kerala

- Lakshadweep

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Mumbai

- Nagaland

- Orissa

- Pondicherry

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- Uttar Pradesh

- Uttarakhand

- West Bengal

CSR Funding

Corporate Social Responsibility (CSR)

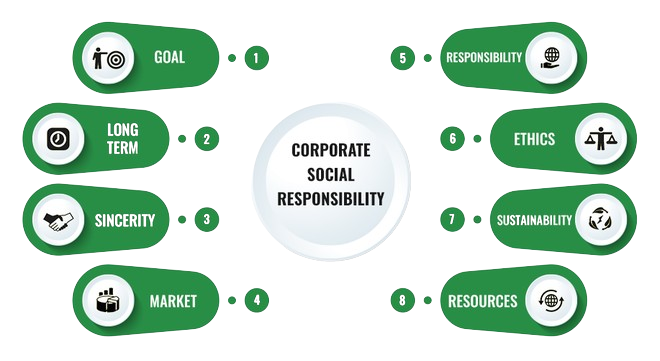

Corporate Social Responsibility (CSR) is the funding and grants process under which Non-Profit Organisations (NGOs) can get financial and other support from the corporate sector. Under the Companies Act, 2013 it is a mandatory provision to provide a contribution of 2 percent of the average net profits of companies. CSR is required and applicable according to Sub-Section 1 of Section 135 of Companies Act, 2013. According to the Companies Act, the CSR provision is applicable for a company having a net worth of rupees 500 carores or more, or a turnover of rupees 1000 carores or more or a net profit of rupees 5 carores or more during any financial year. The company also has a Corporate Social Responsibility Committee of the Board.

The funds provided under Corporate Social Responsibility are for social development issues and make a positive impact on the living standards of the economically poor and disadvantaged people of society so they can live a productive and dignified life.

The CSR is a corporate initiative to assess and take responsibility for the company’s effects on the environment and impact on social welfare. CSR is related to efforts of companies for environmental protection and promotes positive social and environmental change.

The provisions of this Act are social welfare programmes and activities including promotion of education, health, water, environment, social empowerment, employment generation vocation skills for youth and women, child welfare and the differently abled people (divyang) by the livelihood enhancement projects.

How to get CSR Funding

• To get Empanelment with “National CSR Hub” at the Tata Institute of Social Sciences (TISS)

• Through the Companies who can Provide funding under Corporate Social Responsibility (CSR)

CSR Policy, Rules, Regulations and CSR Guidelines of Government of India

Companies can Provide CSR Funding in India

• Indian Companies (leading) who can provide Funding under Corporate Social Responsibility (CSR Funding)

• Indian Companies can provide Funding Under CSR (Unlisted : as according to Income Tax Department declaration)

CSR Information for Corporates and NGOs

To know the official applicable rules, information and guidelines you can check here at Official website of Government for CSR