NGO Registration

- NGO Registration

- Difference in Company, Society and Trust

- How to Start NGO – Form, Register and Run NGO

- Why to Register NGO

- How to run and manage NGO?

- Society Registration

- Society Registration Process and Procedure

- Name Change Process for Society

- How to Register NGO

- Societies Registration Act, 1860

- Public Charitable trust

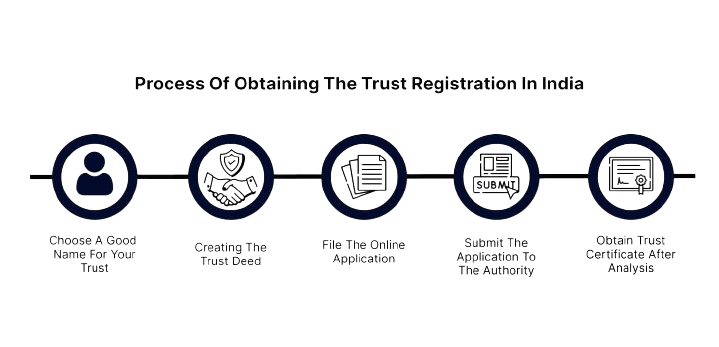

- Registration Process of Public Charitable Trust

- After Registering the Public Charitable Trust

- Section 8 Non Profit Company Registration

NGO Resources

- NGO Resources

- NGO & Government of India

- NGO Partnership Registration

- Relations of NGOs with Business and Commerce

- Public Grievances Resolution related to Government

- Social Calendar

- NGO Management

- NGO Support

- What is NGO

- Voluntary Organisations and Volunteerism

- NGOs : Classification, Definitions, Typologies and Networks

- Understanding NGOs

- Can any Government Employee or Officer be the member of NGO?

- Income Exemption u/s 35AC Revoked

- Aims, Objectives & Programmes for NGO

NGO Funding & Grants

- NGO Funding

- Fundraising

- Funding and Grant Schemes

- Govt Schemes

- How to raise Funds for NGO

- Project Proposal Process

- Fundraising Ideas and Concepts

- Funding Agencies

- CSR Funding Empanelment by National CSR Hub

- CSR Funds through Corporate

- CSR Policy, Rules, Regulations and Guidelines of Government

- Government Funding Ministries

- International Funding Agencies

- Google for Nonprofits

- Fellowship

- CSR Funding

- Fund Raising

- Government Funding

- Grant Proposal for NGO Writing Preparation Process

- Project Proposals

Indian Non-Profits

- Andaman Nicobar

- Arunachal Pradesh

- Andhra Pradesh

- Assam

- Bihar

- Chandigarh

- Chhattisgarh

- Dadra Nagar Haveli

- Daman and Diu

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jammu Kashmir

- Jharkhand

- Ladakh

- Karnataka

- Kerala

- Lakshadweep

- Madhya Pradesh

- Maharashtra

- Manipur

- Meghalaya

- Mizoram

- Mumbai

- Nagaland

- Orissa

- Pondicherry

- Punjab

- Rajasthan

- Sikkim

- Tamil Nadu

- Telangana

- Tripura

- Uttar Pradesh

- Uttarakhand

- West Bengal

After Registering the Public Charitable Trust

What to do after registering the NGO as the Public Charitable Trust?

Resolutions

After you receive the registration certificate of your Trust you can begin working. You can formulate an executive committee. There are no limitations like maximum or minimum number of people in the executive committee. Certain resolutions to be passed by the Trust are:

Resolution regarding the addition, removal or any other change in the Board members/ governing council or Trustees.

- Resolution regarding the executive committee like the names of members in it, defining their role, awarding them designations like the Chairman, Secretary, Treasurer etc. Designations can be decided as per the number of members.

- Resolution to decide certain executive bodies or members for long term like patronizing council or managing trustees etc.

- Resolution to open new branches or offices and deciding the working area.

- Resolution to decide activities programs and projects etc. Assigning duties to each member in this regard.

- Resolution to form any subcommittee or forum at regional or local level.

- Resolution to associate with other Trusts/ organization in future.

- Resolution to conserve minutes of each meeting.

- Resolution to prepare legal seal and stamp of the Trust.

- Resolution to obtain a Pan Card in the Trust’s name.

- Resolution to open a bank account. The resolution should contain every minute detail regarding the operation of bank account, members authorized by the Trust to operate it, whose signature shall be considered valid for the bank transactions etc.

To open a bank account in the name of the Trust you will have to produce the original Trust Deed and its duly attested photocopy to the bank official. It can be opened by a single person if authorized in the resolution. The registered office address mentioned in the Trust deed can be used while opening the bank account. In case you wish to use another address it should be passed by a resolution. Though not clearly defined by RBI and government but some bank officials make Pan Card in the Trust’s name compulsory for opening bank account. Due of lack of knowledge about legal parameters sometimes bank officials pose obstacles in opening a bank account. If this is the case and any official is challenging a document presented ask them for a written reply. You can even file a complaint with higher authorities or RBI in such case.

To avoid unnecessary delay in opening bank account office bearers of the Trust can contact banks and ask them to clear the exact process. After opening a bank account you can change operating members any time after passing a resolution. Nobody can refuse to open a bank account based on the area of operation. - Resolution to make any change in the Trust Deed. In such case a new Trust Deed will be formed, signed by each member and registered at the Registrar office.

Remember, all the resolutions must be printed and signed by every member. Each resolution is passed democratically by upholding the decision of majority.